Did you know that a 1943 copper penny once sold for over $1 million? While most coins don’t reach those heights, many people unknowingly possess coins worth far more than their face value.

Whether you’ve inherited a box of old change, stumbled upon a silver dollar, or are simply curious about your collection, understanding coin value can turn casual interest into a rewarding financial opportunity.

As a professional personal finance advisor, I’ve seen firsthand how overlooked coins can become valuable assets.

If you’ve been asking yourself, “What are my coins worth?” know that it’s important to understand how rarity, condition, metal content, and market demand intersect to determine real-world value. This guide will walk you through the essentials.

Here’s what we’ll cover:

- The key factors that influence coin value (the “5 Cs” of coin collecting).

- The different types of coin values (book, buy, retail, and wholesale) and how they apply.

- How to grade your coins and why condition can make or break their worth.

- Effective methods and tools to check your coin value accurately.

- When and how to get a professional appraisal and how to prepare for one.

By the end of this article, you’ll have a clear, step-by-step understanding of how to evaluate your coins, what influences their worth, and how to take the next step, whether that means selling, holding, or just appreciating what you have.

Understanding the 5 Cs of Coin Value

There are many ways to sell gold coins and other valuable coins, but the first critical step is to understand what influences the value of your coins.

Coin values are driven by five foundational factors: Condition, Composition, Country, Circulation, and Cost/Investment.

Condition

The “grade” of a coin can dramatically impact its value. Coins are graded on a scale from Poor (P-1) to Mint State (MS-70).

Even small differences in condition can translate into big differences in price.

- Mint State (MS): No wear, often with original luster.

- Extremely Fine (EF or XF): Light wear on high points.

- Good (G): Heavily worn, but design still visible.

Composition

A coin’s metal content directly affects its melt value.

- A U.S. silver dollar minted before 1965 contains 90% silver.

- Many gold coins, like the American Gold Eagle, contain 91.67% pure gold.

Country and Year of Minting

Some coins are rarer due to mint location or historical events.

- U.S. coins with a “CC” mintmark (Carson City) are sought after.

- Coins minted during wartime often carry extra collectible value.

Circulation

Low-mintage or uncirculated coins are generally worth more.

- Check mintage figures in coin catalogs or online databases.

Cost/Investment Factors

Unique traits can add substantial value:

- Special serial numbers or varieties

- Mint errors

- Historical provenance

Types of Coin Values You Should Know

- Book (Catalog) Value: The average retail value listed in coin price guides.

- Buy Price: What a dealer will pay you (usually lower than retail).

- Retail Value: What you’d pay to buy the coin from a dealer.

- Wholesale Value: Used in dealer-to-dealer sales; lower than retail but higher than public buy prices.

Coin Grading: The Role of Condition in Value

Grading Scales

The Sheldon Scale ranges from 1 to 70.

- MS-70: Perfect condition under magnification.

- EF-40: Light wear, all details visible.

- G-4: Heavily worn but identifiable.

Professional Grading Services

- NGC (Numismatic Guaranty Corporation)

- PCGS (Professional Coin Grading Service)

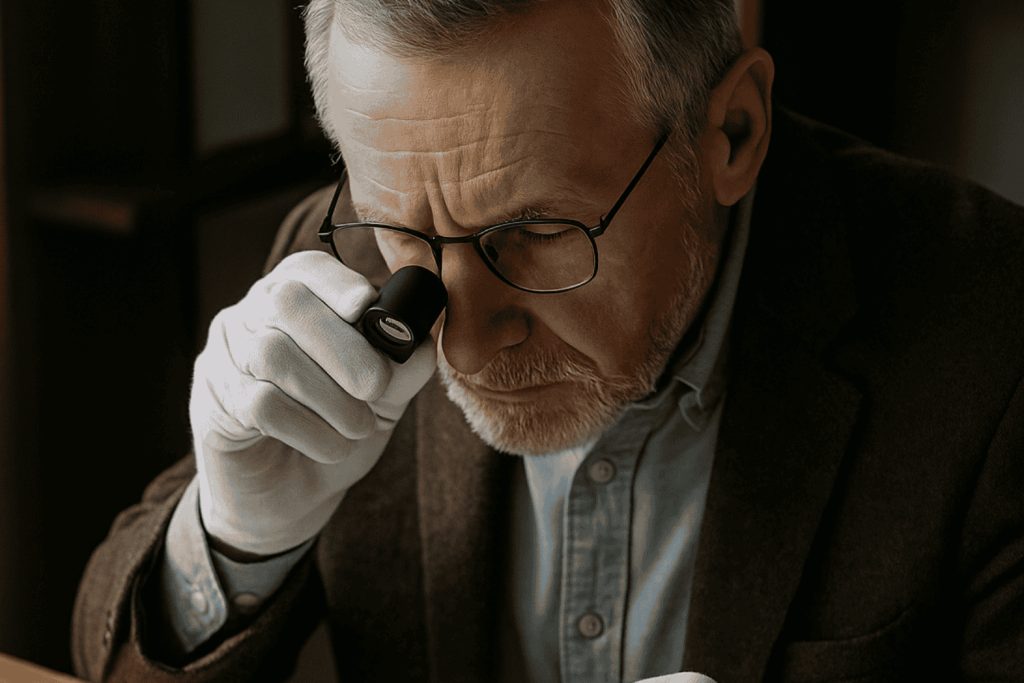

DIY Grading Tips

- Use a 10x magnifying glass and bright lighting.

- Compare to reference images in grading guides.

- Handle coins by the edges.

How To Check Coin Value Accurately

Market Research

Check completed auctions on eBay, Heritage Auctions, or Stack’s Bowers.

Metal Value Calculation

- Multiply weight × metal purity.

- Multiply result × current spot price.

Online Tools

Silver and Gold Coin Valuation

Silver Coins

- U.S. coins before 1965 usually contain 90% silver.

- Multiply silver weight × spot price, then add collector premium.

Gold Coins

- Identify purity (e.g., 22k).

- Multiply gold weight × spot price.

- Add rarity and historical premiums.

Coin Appraisal: When and How

- Online Appraisals: Quick but may miss subtle details.

- In-Person Appraisals: Most accurate for grading, authenticity, and market insight.

- Hybrid Approach: Start online, then confirm in person for higher-value coins.

Preparing for an Appraisal

- Group coins by country, denomination, and year.

- Separate by metal type.

- Gather receipts, certificates, and provenance documents.

- Never clean your coins.

Why Authentication and Timing Matter

- Authentication prevents buying/selling counterfeits.

- Timing sales with market trends can improve returns.

Key Takeaways

What are my coins worth? The answer depends on the 5 Cs, accurate grading, market research, and sometimes a professional appraisal. Coins can be more than just spare change; they can be historical artifacts, investments, and treasures.

Next Step:

If you’re ready to uncover the true value of your collection, schedule a professional coin appraisal to get an expert evaluation.

References:

- How to Sell Gold Coins – Ultimate 2025 Guide

- NGC Coin Grading Scale | About Coin Grades | NGC

- NGC Coin Price Guide and Values | NGC

- Coinoscope – Identify coins by image

- NumisMedia Online Collector FMV Rare Coin Price Guide – Fair Market Value Prices for United States Rare Coins – Market, PCGS, NGC, FMV, CAC, and Plus Retail and Wholesale Values