Maintaining strong financial health is essential to achieving your goals, whether you’re buying a home, starting a business, or simply building a stable future. A critical part of that foundation is your credit score and credit report. Understanding how they work—and how to improve them—can open doors to better financial opportunities.

What Is a Credit Score?

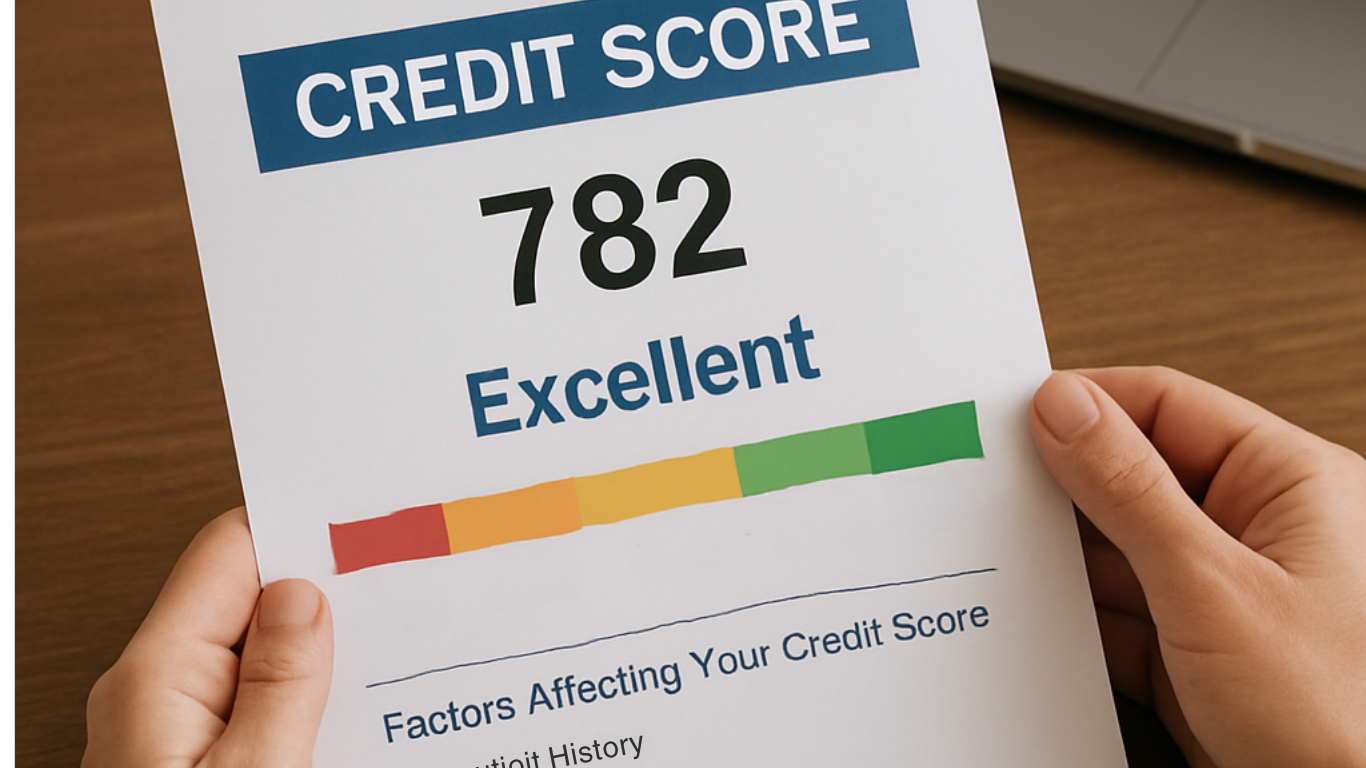

A credit score is a three-digit number that represents your creditworthiness. Lenders use it to determine how likely you are to repay borrowed money. Scores typically range from 300 to 850, with higher scores indicating better credit health.

Common Credit Score Ranges

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

Credit scoring models may vary, but FICO and VantageScore are the two most widely used in the U.S.

How Credit Scores Are Calculated

Your credit score is calculated based on several key factors:

- Payment History (35%): On-time payments build credit; late or missed payments hurt it.

- Amounts Owed (30%): Using a high percentage of your available credit may indicate risk.

- Length of Credit History (15%): A longer history can improve your score.

- Credit Mix (10%): A healthy mix of credit cards, loans, and mortgages is favorable.

- New Credit (10%): Opening many accounts in a short period can lower your score.

What Is a Credit Report?

A credit report is a detailed record of your credit history. It’s maintained by credit bureaus—Experian, Equifax, and TransUnion—and used to calculate your credit score. Lenders, landlords, insurers, and even employers may review your credit report when evaluating your financial trustworthiness.

What’s Included in a Credit Report?

A credit report typically includes:

- Personal information: Name, address, Social Security number, and employment history.

- Credit accounts: Details of loans and credit cards, including balances, limits, and payment history.

- Credit inquiries: Who has accessed your report and why.

- Public records: Bankruptcies, tax liens, or civil judgments (if applicable).

- Collections: Unpaid debts referred to collection agencies.

Why Credit Scores and Reports Matter

Your credit score and report play a vital role in many aspects of life. They affect your ability to:

- Qualify for loans or credit cards

- Secure lower interest rates

- Rent an apartment

- Get approved for utilities or cell phone plans

- Land certain jobs (especially those in finance)

Even if you’re not planning a big financial move now, good credit can offer flexibility and peace of mind down the road.

How To Check Your Credit Report and Score

Getting Your Free Credit Report

Federal law entitles you to a free credit report from each of the three major bureaus once per year. You can request yours at:

Accessing Your Credit Score

Your credit score is not always included in the free report, but there are several ways to access it:

- Through your credit card provider or bank

- Using free credit monitoring apps (e.g., Credit Karma, Credit Sesame)

- Purchasing it directly from the credit bureaus

Tips To Improve Your Credit Health

Pay Bills on Time

Timely payments are the most important factor in your credit score. Set up automatic payments or reminders to avoid missed due dates.

Reduce Your Credit Utilization

Aim to use less than 30% of your available credit. If your total credit limit is $10,000, try to keep your balances below $3,000.

Don’t Close Old Accounts

Even if you no longer use a credit card, keeping the account open can benefit your credit history and utilization ratio—unless it carries fees.

Limit Hard Inquiries

Each time you apply for credit, a hard inquiry appears on your report and may slightly lower your score. Avoid opening too many new accounts at once.

Dispute Errors Promptly

Inaccuracies on your credit report can harm your score. If you spot a mistake, file a dispute with the reporting bureau to have it corrected.

Common Myths About Credit

Checking Your Own Credit Hurts Your Score

False. When you check your own credit (a soft inquiry), it does not affect your score. Only hard inquiries initiated by lenders have a minor impact.

You Need To Carry a Balance to Build Credit

False. Paying off your balance in full each month is best. It shows responsible credit use and helps you avoid interest charges.

Closing a Card Always Helps

Closing a credit card can actually hurt your score by reducing your available credit and shortening your credit history.

Rebuilding Damaged Credit

If your credit has taken a hit, it’s never too late to rebuild.

- Start with a secured credit card: These require a deposit and can help establish positive payment history.

- Become an authorized user: Ask a trusted family member to add you to their credit card account.

- Use credit builder loans: These are small loans where payments are held in a savings account until fully repaid.

Consistency is key. Over time, these steps can significantly improve your credit profile.

Final Thoughts: Credit Is Part of Your Financial Wellness

Credit scores and reports are more than just numbers they’re tools that influence your financial future. By understanding how they work and how to manage them wisely, you can take control of your financial health.

Monitoring your credit regularly, making informed choices, and practicing smart financial habits can help you build a stronger, more secure foundation. Whether you’re working to improve your credit or maintaining an already strong score, every step counts toward your long-term financial well-being.

References: